Raising capital is essential for the success, and even survival, of any new Pakistani startup. Many business owners start with their own personal capital before realizing that they need more money to keep their business running.

Thankfully, there are many different options and sources of investment for new startups. For simplicity sake, it is best to consider the different stages of startup fundraising. This way, you can assess which stage your startup is at, and make investment fundraising decisions wisely.

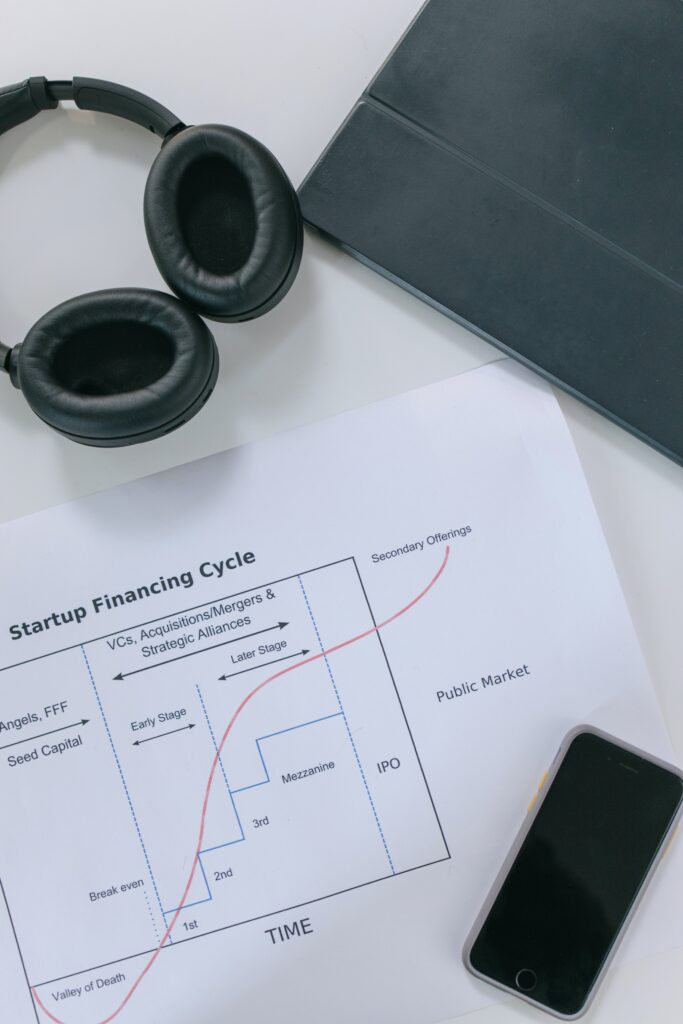

Stages of Startup Fundraising

- Pre-Seed Round

Pre-seed funding is the earliest funding round whereby investors provide a startup business with capital to develop its product in return for equity in the company. At this stage, capital raised is usually not more than $2 million. Moreover, investors at the pre-seed round tend to be friends, family, or the business owners themselves who invest in the startup.

- Seed Round

The pre-seed round raises just enough capital to take the business idea off the ground, but it is not long before a startup will require seed fundraising. This is the first official equity funding stage. The most common sources for raising seed money are family, friends, new business incubators, angel investors and venture capital investors.

- Series A

Once the startup has established itself in the market and developed a user base, it is a good time to consider Series A funding. At this point, businesses are usually generating between $2 million to $15 million in revenue, and have formed a solid long-term business plan. The most common source for Series A funding are more traditional and well-established venture capital investment firms.

- Series B

Series B funding occurs once the business has reached the growth stage. This is all about expanding and raising the capital needed to support high demand. At this point, the business has proven to investors that it has major growth and profitability potential. This stage is similar to Series A, but there will be an incorporation of more Venture Capital firms that specialize in later stage investment. There also tends to be a key anchor investor that helps to draw in other investors.

- Series C

Businesses that reach the Series C funding stage have already become quite successful and want to scale their operations. At this point, they may be seeking more investment to tap into a new segment, explore a new market, or test out a new product with additional marketing research. In Series C funding, groups such as hedge funds, investment banks, private equity firms, and large secondary market groups enter the picture.

- IPO

Successful companies that make it past Series C funding may reach the finish line, also known as the Initial Public Offering. This happens when the business decides to “go public” and sell shares on the stock exchange to raise capital. By definition, the IPO process of making shares of a private company available to the public (on the stock market) in order to raise capital.

These are the major stages of startup fundraising for startups. Interested in learning more? Contact us at Metric today – we offer the best bookkeeping, accounting, valuation, and financial consulting services for businesses!